Are you looking for poor credit car loans in Canada? You have a window of opportunity where you can get a great deal, but you will need to move quickly and with purpose.

Our goal is to show you the simplest way to deal with your poor credit and get approved for a car loan ASAP.

How poor is your credit?

This is not a rhetorical question; you need to look at both your Equifax and TransUnion credit reports to see how bad things are before you do anything else.

There is no cost to access your credit report and score, so you should make it a regular habit to always check your credit score.

A credit score of 600-680 is considered fair to good, depending on who you ask, anything under 600 is considered subprime and anything over 700 is considered very good.

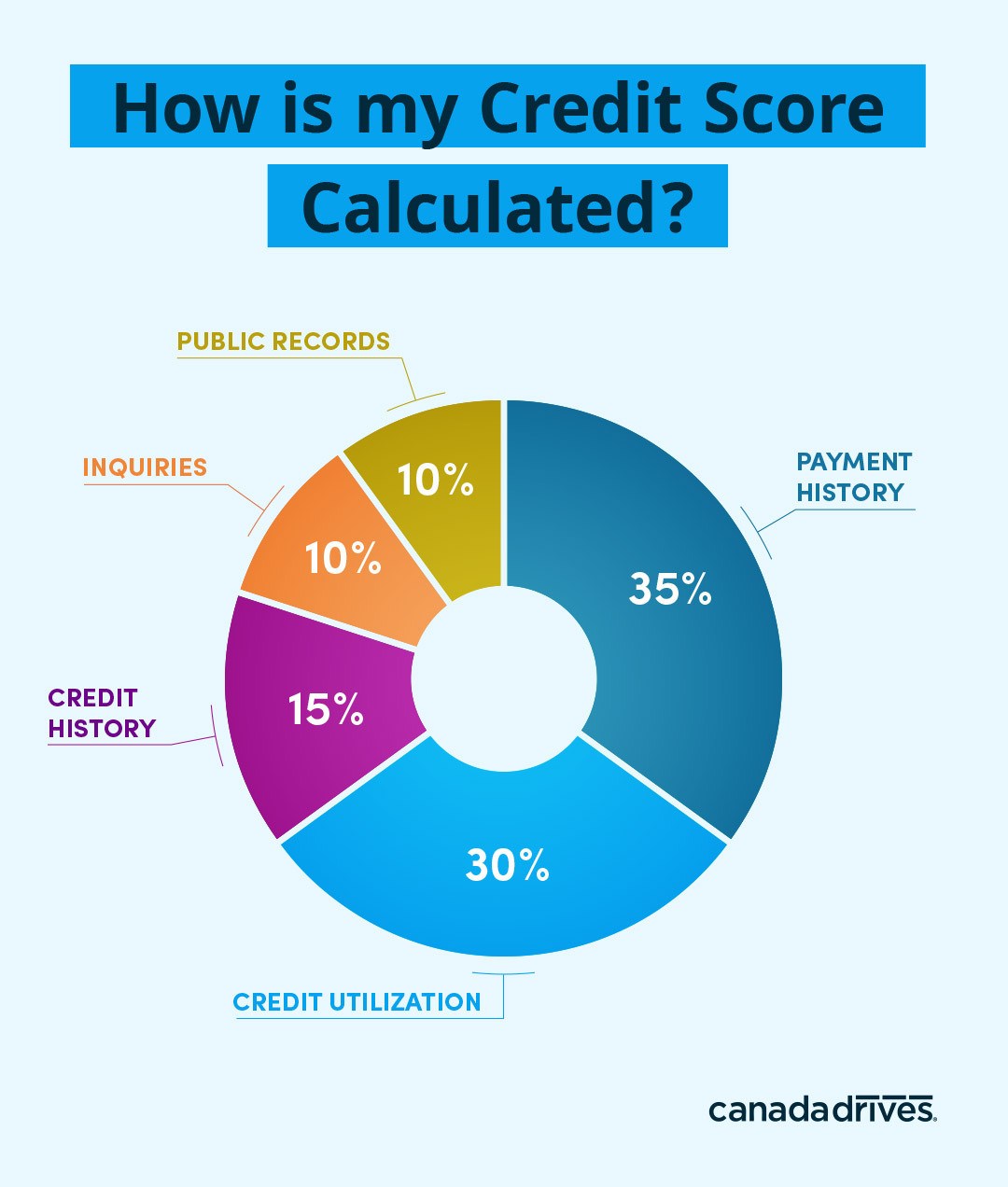

While your credit score provides an instant snapshot of how you manage your finances, it is not everything.

What some lenders do is look for specific items inside your credit report beyond the score to determine whether to approve the loan.

An instant red flag for most lenders is if there is a recent vehicle repossession on the credit report. For some lenders, missing even a single payment in the last 12 months could be a reason to decline your loan application.

This is why you must access your credit report, so you can understand what is weighing down your credit score and the steps you must take to turn things around.

How to improve your credit score without using gimmicks

There is a gimmick-free way to improve your credit score, it may sound too simple to work, but it does.

The first thing is to make sure none of your accounts go past due; bring your accounts up to date, even if it means you have to take on a second job for extra income.

After you have brought your accounts up to date, work on paying down the balance. Start with the smallest debt and work your way up to the biggest; this is referred to as the “debt snowball method.”

The less debt you are carrying, the more money you will save and the higher your credit score.

Where to get a poor credit car loan today

If you made it to this point in the conversation, you probably need a car today and can’t wait for your credit score to improve organically.

What you can do is work with a local dealership that offers support for poor credit car loans in Canada. Like us!

The dealership will work with its extensive network of lenders to find the loan that works for you and your budget.

With interest rates rising in Canada, you should contact the dealership ASAP to get the loan underwriting process going.

For those of you who know that you have a challenging credit situation, please visit Dixie Auto Loans where we have a team of credit specialists ready to help you get approved for poor credit car loans in Canada today!!