Our Resources

Consumer Proposal Car Loans: Get Pre-Approved Today

Consumer Proposal Car Loans: Get Pre-Approved Today

If you’re looking for car loans after a consumer proposal in Canada, there are some important steps you should follow if you want to start leading a better quality of life.

The first thing we need to square away is you have completed the consumer proposal and have been discharged.

If you have not been released from the consumer proposal, then technically, you are not allowed to take on any new debts.

Your Reason for a Consumer Proposal

Prospective lenders will want to know why you ended up in a consumer proposal. Did you suffer a relationship breakdown, or did you lose your job due to the pandemic?

There are many different reasons why an individual can end up in financial strife; having an explanation can demonstrate that you have taken responsibility for the situation, which doesn’t guarantee approval but shows you are serious about your finances.

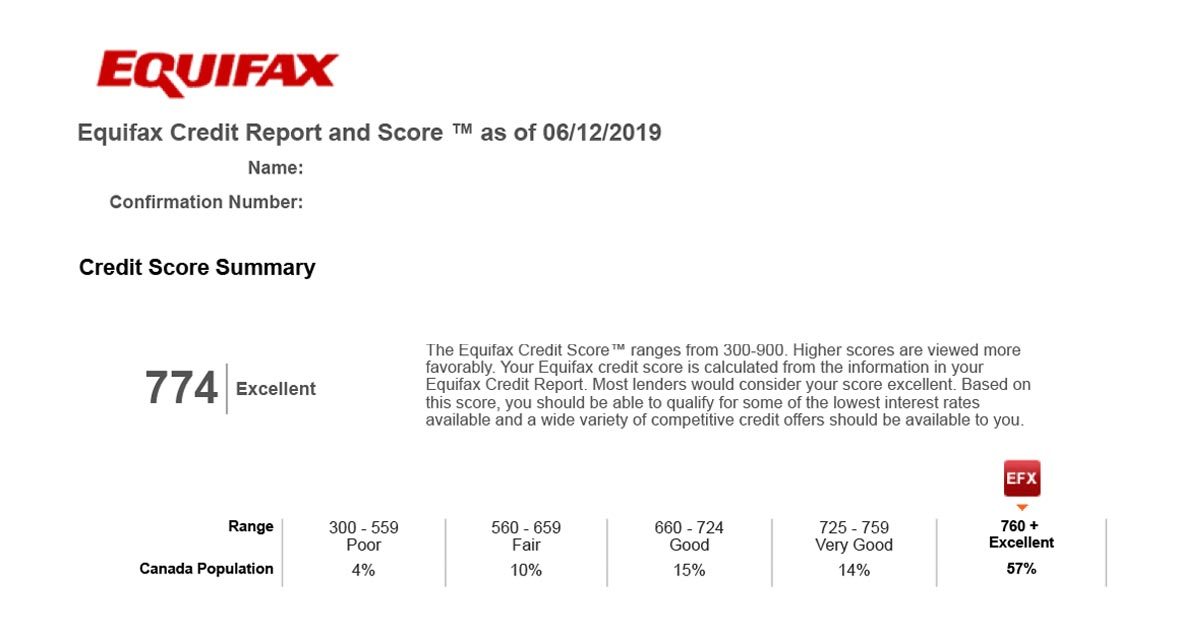

Consumer Proposal Impact on Your Credit Score

In essence, the consumer proposal asks your creditors to forgive a portion of your debt and extend the time you have been granted to repay the balance.

Naturally, this makes things very difficult for the creditors, who will inform Equifax and TransUnion about it.

Your credit report will reflect this adverse status for a maximum of seven years, which could increase the cost of future credit.

Rebuilding Your Damaged Credit Score

Thankfully our credit score is constantly changing, so you can rebuild your score in short order, but you need to use the right approach.

The approach we are going to discuss does not utilize gimmicks or scams but industry best practices.

Kick things off by getting free access to your credit report; you can get access with both Equifax and TransUnion; it doesn’t cost you anything, so you have no excuse for not signing up.

Each of these credit reporting agencies has its own credit scoring model, so you need to stay on top of both of them.

Opening Up New Credit Tradelines To Improve Your Credit Score

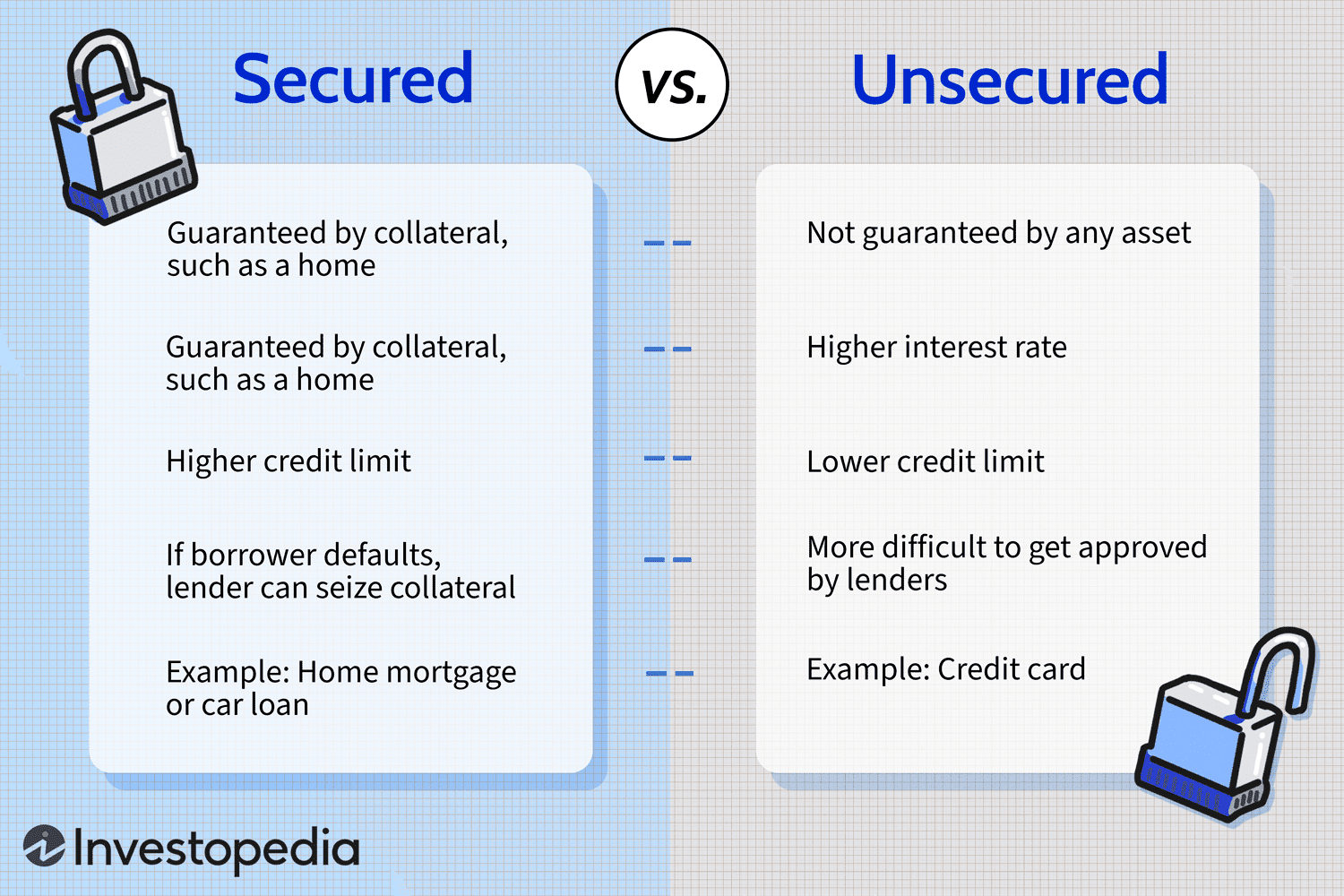

After you have signed up for free credit reports with TransUnion and Equifax, you need to open new credit tradelines to improve your credit score, preferably not with the companies that were part of your consumer proposal.

The majority of creditors out there will not approve you for car loans after a consumer proposal on file.

What you need to do is open up a secured credit card account with Capital One and a credit-building loan from Koho.

These secured services will create positive, new tradelines on your credit report, which will start to build your credit score over time.

The most important thing you need to bear in mind is this is your chance to make a fresh financial start, so be sure to keep your payments current, or you could find yourself back to where you started with the consumer proposal.

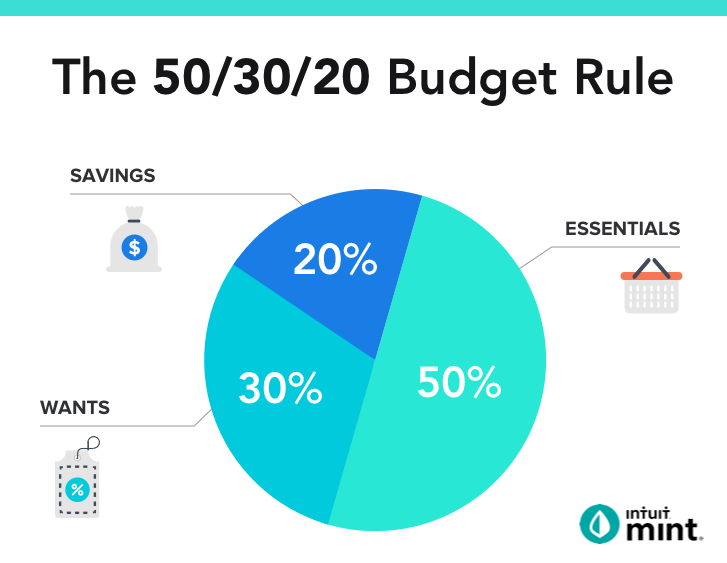

Finding Room In Your Budget For The New Car

Something you will need to do is work out your budget to determine how much cash you have available and can put it towards the new car payment.

The average car payment in Canada is around $600 per month; this amount does not take into consideration insurance, fuel, and maintenance, so you should plan on spending around $1,000 a month to have a car in Canada.

Where To Find Car Loans After a Consumer Proposal

Now that you know how to get a car loan after a consumer proposal contact your local dealership today and start exploring your options.

You will need to find a dealership in your area that works with buyers who have experienced credit challenges.

The dealership will know which lenders are willing to give you a second chance without charging usurious interest rates in the process.

If you’re ready for a car loan, we’d love to help! simply click here to get pre-approved online today.